(BCN editor’s note: This is the first of two Ken Blackwell columns for Thursday. Also, the committee mentioned in the article has delayed the vote.)

(BCN editor’s note: This is the first of two Ken Blackwell columns for Thursday. Also, the committee mentioned in the article has delayed the vote.)

A critical vote may await the Senate upon its return next week.

The Senate Banking, Housing, and Urban Affairs Committee is scheduled to vote on a massive proposal to overhaul the nation’s mortgage finance market. Yet the draft language released by the authors – Chairman Tim Johnson (D-SD) and Ranking Member Mike Crapo (R-ID) — has raised concerns across the political spectrum.

Organizations and individuals at polar ends of the political landscape, from Ralph Nader on the left to the Independent Community Bankers Association on the right, and from the right-leaning 60 Plus to the left-leaning NAACP, have all voiced objection to parts of this mammoth legislation. Others, such as HUD Secretary Shaun Donovan and the National Association of Realtors have been more supportive of the bill. Who is right and what should Senators do?

There is surprising consensus throughout the political spectrum on the goals of housing finance. The system needs to be reformed to attract more private capital, reduce the direct role of government involvement, and avoid any instability that would threaten the nascent housing recovery. The best element of the current system, the widespread availability of a 30-year fixed rate mortgage for families with sound credit and some ability to put money down, should be maintained. The question is not only how to get there, but also what are the risks of setting up the wrong system.

If you err in one direction, you can create a system that simply doesn’t attract private capital. Let’s face it, in a world with global competition for the best returns to housing capital, U.S. residential mortgages are not very attractive. The overhang of the recent financial crisis, sparked by a mortgage market gone haywire, looms large.

Further, the government’s attempt to wipe out existing private capital invested in the publicly traded stock of housing finance companies serves as a strong disincentive to other private investors. As consumer advocate Ralph Nader put it, “Taxpayers, consumers and shareholders should have serious reservations about this proposal for housing finance reform… It sets an objectionable precedent for shareholder rights and treatment in this country.” The key point is that by abridging property rights for existing private capital, the legislation cannot succeed in bringing private capital back into the housing market.

Bernard L. Weinstein, a professor at the Cox School of Business at Southern Methodist University and a fellow with the George W. Bush Institute also adds, “[t]he Johnson-Crapo bill is the wrong approach to a Fannie and Freddie wind-down. It is tantamount to an uncompensated government taking that violates the “rule of law” and ignores private property rights.”

Without private capital engaged, taxpayers will be on the hook for irresponsible lending similar to what happened in the financial crisis. The Independent Community Bankers Association, along with Credit Union trade associations, raised the concern that the current proposal will overly concentrate mortgage lending with large financial institutions. They told senators in a letter that “Any housing reform proposal must ensure equal and competitive access for community banks and credit unions, while avoiding further concentration of the primary and secondary mortgage markets to the largest lenders and Wall Street firms.” The current proposal fails to meet that test, in their opinion.

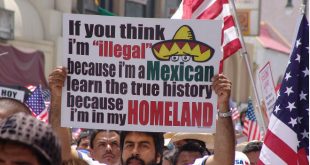

The Senate proposal may well eliminate the ability for millions of American families, particularly those in communities of color, to even be able to afford a home. The NAACP, joined by the National Council of La Raza, the National Coalition for Asian Pacific American Community Development, the Center for Responsible Lending, and other civil rights groups, wrote, “The new Senate proposal to reform the housing finance system would needlessly make mortgages more expensive and less available….[and] would widen the existing wealth gap and lock out the very borrowers the market needs to operate in a healthy manner.”

Restricting the ability of first time homebuyers, who historically make up 40 percent of the market, to obtain mortgages would substantially decrease home prices. The result would be to roil the housing market for current homeowners as well as future borrowers.

Jim Martin, chairman of 60 Plus, an organization that advocates for older Americans, said, “Millions of retirees and others will lose their savings from this broad government overreach built into the Johnson-Crapo legislation.”

With stakes as large as the ability to buy a home for millions of families and the retirement security for millions more, it is critical that we get housing finance reform right. If that takes more time to work out these complicated issues, then that is time well spent.

What the U.S. cannot afford is to adopt the current draft of the Crapo-Johnson bill before the Senate Banking Committee. It leaves too many questions unanswered and puts at risk the small gains homeowners and shareholders have made since the housing crisis in 2008. Moving forward without addressing the underlying problems in the legislation would be a disaster for the future of housing finance in America. Most importantly, it’s imperative that leaders in Washington take the necessary time to get this issue right. The fate of millions of families depends on it.

Ken Blackwell is a senior fellow at the Family Research Council and the American Civil Rights Union, and on the board of the Becket Fund for Religious Liberty.

Ken Blackwell is a senior fellow at the Family Research Council and the American Civil Rights Union, and on the board of the Becket Fund for Religious Liberty.

Photo credit: Dan Moyle (Creative Commons)

Black Community News News and Commentary for Christians

Black Community News News and Commentary for Christians